DOJ Criminal Division Announces Revisions to its Corporate Enforcement Policy

In Short

The Situation: On January 17, 2023, the U.S. Department of Justice ("DOJ" or "Department") announced significant revisions to the Criminal Division's Corporate Enforcement Policy.

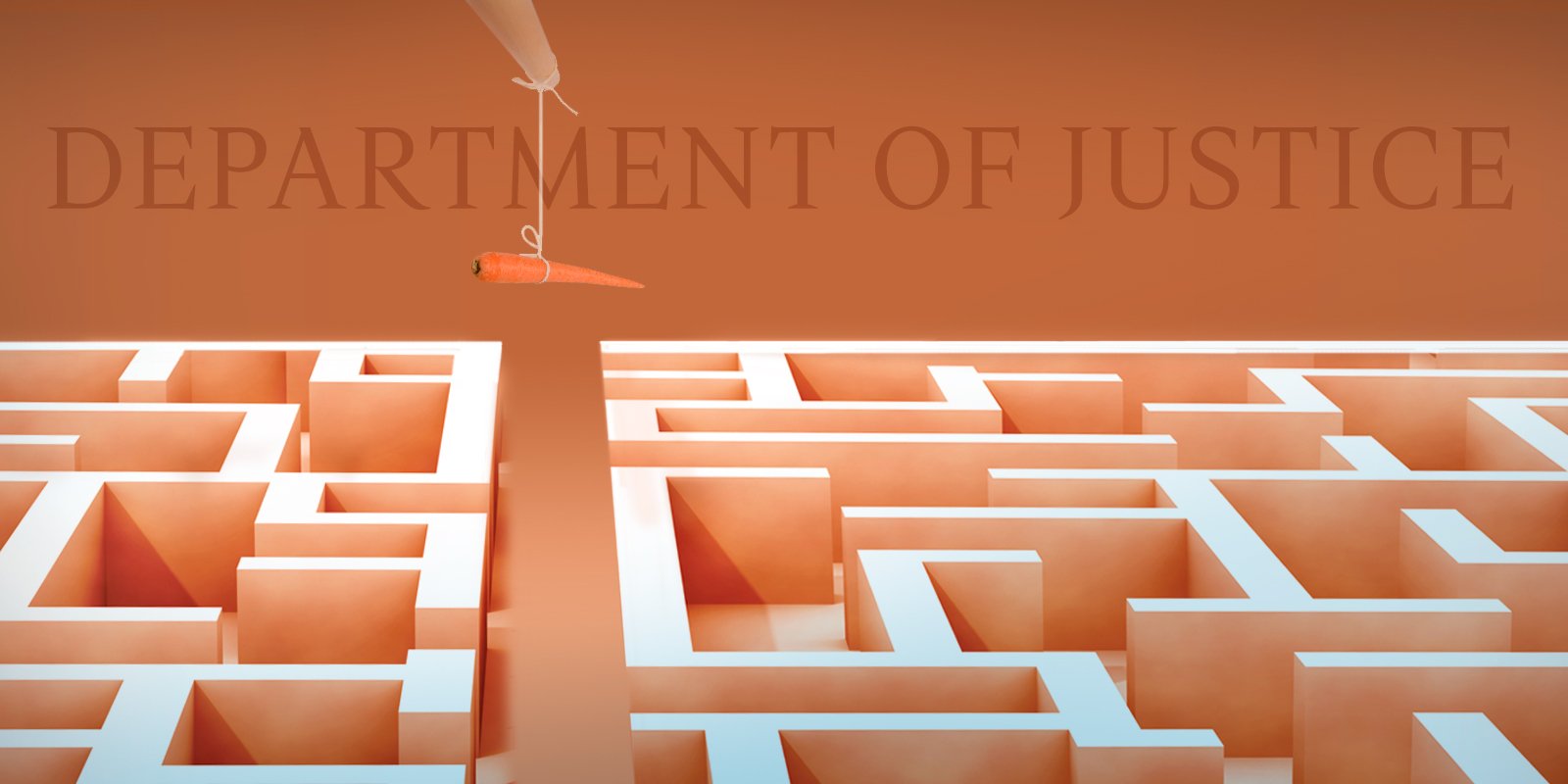

The Result: The new Policy changes build on DOJ's existing "carrots and sticks" that are intended to encourage companies to self-disclose corporate criminal conduct and cooperate with DOJ's efforts to prosecute individual wrongdoers. Most significantly, the revised Policy provides a path for companies with what DOJ considers "aggravating circumstances" to now qualify for maximum cooperation credit and receive a declination of prosecution. In addition, the Criminal Division's Corporate Enforcement Policy ("CEP") meaningfully increases the available fine discounts for companies that meet the CEP's rigorous requirements.

Looking Ahead: The path to receiving the full benefits available under the new CEP is a narrow one and leaves prosecutors with significant discretion to determine the form of any eventual resolution and the size of any fine. Companies considering whether to self-disclose misconduct to the Criminal Division must continue to carefully weigh the pros and cons of self-disclosure to DOJ, including the incentives provided by the new CEP as well as potential collateral consequences, such as civil litigation, parallel investigations by other enforcement authorities, and regulatory actions.

DOJ continues to emphasize the importance of self-disclosure and cooperation by companies that learn of potential criminal misconduct. On January 17, 2023, Assistant Attorney General ("AAG") Kenneth A. Polite delivered remarks that announced significant revisions to the Criminal Division's prior CEP, which is codified at Section 9-47.120 of the Justice Manual. The CEP is an outgrowth of the Criminal Division's existing Foreign Corrupt Practices Act ("FCPA") Corporate Enforcement Policy, which outlined the Division's approach in FCPA cases involving companies that self-disclose wrongdoing and cooperate with investigations. The FCPA Corporate Enforcement Policy created a presumption that, absent any aggravating circumstances, DOJ will decline to take any enforcement action against companies if they: (i) voluntarily self-disclose criminal conduct to DOJ; (ii) fully cooperate with DOJ's investigation; and (iii) take timely and appropriate remediation steps.

In March 2018, the Criminal Division announced that this policy would serve as nonbinding guidance to all corporate cases it prosecutes. In September 2022, Deputy Attorney General ("DAG") Lisa Monaco outlined changes to DOJ's approach to corporate criminal enforcement and called for all DOJ components to issue policies governing voluntary self-disclosure by companies (see Jones Day Commentary, "DOJ Announces Major Changes to Corporate Criminal Enforcement Policies," September 2022). In his remarks, AAG Polite explained that the Criminal Division "took the DAG's call as an opportunity to reassess and strengthen" the then-existing CEP.

Under the prior version of the Policy, the Criminal Division applied a presumption that it would decline to prosecute a company that voluntarily self-disclosed misconduct, fully cooperated with DOJ's investigation, and timely and appropriately remediated the wrongdoing (provided that the company disgorged any ill-gotten gains). This presumption was unavailable, however, in cases involving a broad range of "aggravating circumstances," which included: involvement by executive management of the company in the misconduct; a significant profit to the company from the wrongdoing; egregious or pervasive misconduct within the company; and a history of prior misconduct by the company. Even if a declination was unavailable, the prior version of the CEP nevertheless provided for a fine reduction of up to 50% off of the low end of the applicable U.S. Sentencing Guidelines penalty range for companies that self-disclosed misconduct and fully cooperated with the Division's investigation. Companies that did not voluntarily disclose but fully cooperated and remediated were eligible for a reduction of up to 25% off of the bottom end of the Guidelines range.

The Policy revisions announced on January 17 significantly increase the incentives available to companies that voluntarily self-disclose potential misconduct to the Criminal Division, cooperate with any resulting investigation, and effectively remediate. However, the requirements for companies to receive full credit under the new CEP are stringent, and prosecutors retain significant discretion to determine the form and size of any eventual resolution with DOJ.

Revisions to the DOJ Criminal Division's Corporate Enforcement Policy

New Incentives to Self-Report, Even with Aggravating Factors Present. Similar to the previous FCPA Corporate Enforcement Policy, if there are no "aggravating factors" present, a company can qualify for a presumption of a declination if the company voluntarily self-disclosed the misconduct, fully cooperated, and timely and appropriately remediated. Under the revised Policy, this option is available not only for FCPA cases, but for all cases handled by the Criminal Division.

Under the revised Policy, a company that self-discloses corporate criminal conduct with "aggravating factors" may nevertheless qualify for a declination of prosecution if the company demonstrates it has met three requirements:

- The voluntary self-disclosure was made immediately upon the company becoming aware of the allegation of misconduct;

- At the time of the misconduct and the disclosure, the company had an effective compliance program and system of internal accounting controls that enabled the identification of the misconduct and led to the company's voluntary self-disclosure; and

- The company provided extraordinary cooperation with the Department's investigation and undertook extraordinary remediation.

While these changes are intended to provide an enhanced incentive for companies to self-disclose misconduct and cooperate, it remains to be seen whether they will have this effect in practice. To qualify for a declination with "aggravating factors" under the revised CEP, a company's self-disclosure must be "immediate," its cooperation "extraordinary," and its existing compliance program and internal controls "effective." AAG Polite emphasized that the Criminal Division is "requiring companies seeking the possibility of a declination—even in the face of aggravating factors—to take extraordinary measures before, during, and after a Criminal Division investigation to earn such an outcome."

Companies receiving reports of potential misconduct, however, may not be in a position to make an "immediate" disclosure to DOJ before conducting an adequate assessment of whether the allegations have merit. Well-functioning corporate compliance programs are well functioning in part because they encourage the reporting of suspected misconduct and thereby tend to lead to the reporting of allegations of misconduct, perhaps in substantial quantities. It would be impractical for all companies seeking to maximize cooperation credit to "immediately" self-disclose every allegation of corporate misconduct no matter how facially credible (i.e., self-disclose at the moment the allegation is made). Practically, then, companies should be prepared to expeditiously gather and assess relevant information and thereby enable similarly expeditious and reasonably informed judgments on self-disclosure.

Additionally, it is often unclear at the outset of a matter whether prosecutors will consider a company's compliance program and controls to be effective at the time of self-disclosure. This uncertainty, coupled with the risk of potential subsequent investigations by the SEC, domestic regulators, or foreign regulators and other collateral consequences—such as civil litigation, administrative sanctions, and reputational harm—may lead companies to think twice before disclosing potential misconduct to the Criminal Division.

Increased Fine Reductions for Qualifying Companies. Even if a company does not meet the requirements for a declination, the revised CEP provides significant potential benefits for companies that voluntarily self-disclose misconduct, fully cooperate, and timely and appropriately remediate. In such cases, AAG Polite announced that the Criminal Division generally will not require a guilty plea and also will apply a fine reduction of between 50% and 75% off of the low end of the applicable U.S. Sentencing Guidelines penalty range—up from a previous maximum reduction of 50%. AAG Polite emphasized that in all cases, prosecutors have discretion to determine the starting point within the Guidelines range—including in cases where the company has a history of prior misconduct. In such cases, the reduction generally will not be from the low end of the range.

The revised Policy also provides incentives for companies that do not voluntarily self-disclose misconduct but nevertheless fully cooperate and timely and appropriately remediate. In such cases, the Criminal Division will recommend up to a 50% reduction off of the low end of the Guidelines fine range—twice the maximum amount of 25% available under the previous version of the Policy. As in self-disclosure cases, where a company has a history of prior wrongdoing, the reduction will likely not be off of the low end of the range.

Guidance on Distinguishing Between "Extraordinary" and "Full" Cooperation. While the new CEP provides for the possibility of significant reductions off the Guidelines range in appropriate cases, AAG Polite emphasized the maximum reductions available will not be the "new norm." Rather, each company "starts at zero cooperation credit" and must demonstrate "extraordinary" cooperation and remediation over the course of the case to receive the maximum benefits available under the revised Policy. In his remarks, AAG Polite distinguished between "full" cooperation and cooperation that is "extraordinary" in the Division's view, explaining that the latter requires companies to "go above and beyond the criteria for full cooperation set in our policies—not just run of the mill, or even gold-standard cooperation, but truly extraordinary." What qualifies as truly extraordinary cooperation will vary depending on each case, but AAG Polite provided a number of examples and "note[d] some concepts—immediacy, consistency, degree, and impact—that apply to cooperation by both individuals and corporations … will help to inform our approach to assessing what is 'extraordinary'" cooperation under the revised CEP.

The revised CEP's focus on "extraordinary cooperation" echoes remarks made by DAG Monaco in September 2022, explaining that, to be eligible for cooperation credit, companies must timely disclose information to DOJ. In remarks that Principal Associate Deputy Attorney General Marshall Miller gave on September 20, 2022, Miller was even more direct, explaining that "[t]he Department will expect cooperating companies to produce hot documents or evidence in real time." It remains to be seen how DOJ will distinguish extraordinary cooperation from full cooperation in practice.

Four Key Takeaways

- The changes to DOJ's CEP provide additional incentives to companies that voluntarily self-report corporate criminal misconduct, even when aggravating factors are present.

- Time is of the essence. Upon learning of potential corporate criminal misconduct, a company has a limited window of time to qualify for maximum cooperation credit under DOJ's CEP. It is important to gather, investigate, and assess reliable information in a timely manner to enable the company to make the best informed decisions on whether or not to self-report the conduct in question.

- To remain eligible for maximum cooperation credit in the event of a federal criminal investigation, companies should review and test their compliance programs to ensure that they adequately assess, monitor for, and remediate misconduct.

- A company's decision whether or not to self-disclose potential corporate wrongdoing to DOJ is inherently complex and requires thoughtful consideration on a case-by-case basis. While the announcement provides additional incentives and clarity regarding DOJ's expectations for companies seeking "extraordinary" cooperation credit, a company's self-disclosure decision will necessarily depend on the specific facts and circumstances at issue, and should be driven by an informed assessment of all relevant considerations, including, but not limited to, DOJ policy.