Intelsat closes $6.7 billion DIP-to-exit financing transactions

Client(s) Ad Hoc Intelsat Jackson Unsecured Noteholders Group

On May 13, 2020, Intelsat S.A. and certain of its direct and indirect subsidiaries (the “Intelsat Parties”) filed voluntary petitions with the U.S. Bankruptcy Court for the Eastern District of Virginia commencing their respective cases under Chapter 11 of the Bankruptcy Code. Jones Day represented certain creditors of the Intelsat Parties in their capacity as lenders and purchasers in a series of financing transactions conducted by Intelsat Jackson Holdings, S.A. in connection with the Intelsat Parties’ upcoming emergence from Chapter 11 bankruptcy proceedings. The transactions consisted of (i) a private placement of $3 billion aggregate principal amount of 6.500% Senior Secured Notes due 2030 and (ii) a senior secured credit agreement consisting of a $500 million revolving credit facility and $3.190 billion term loan B facility.

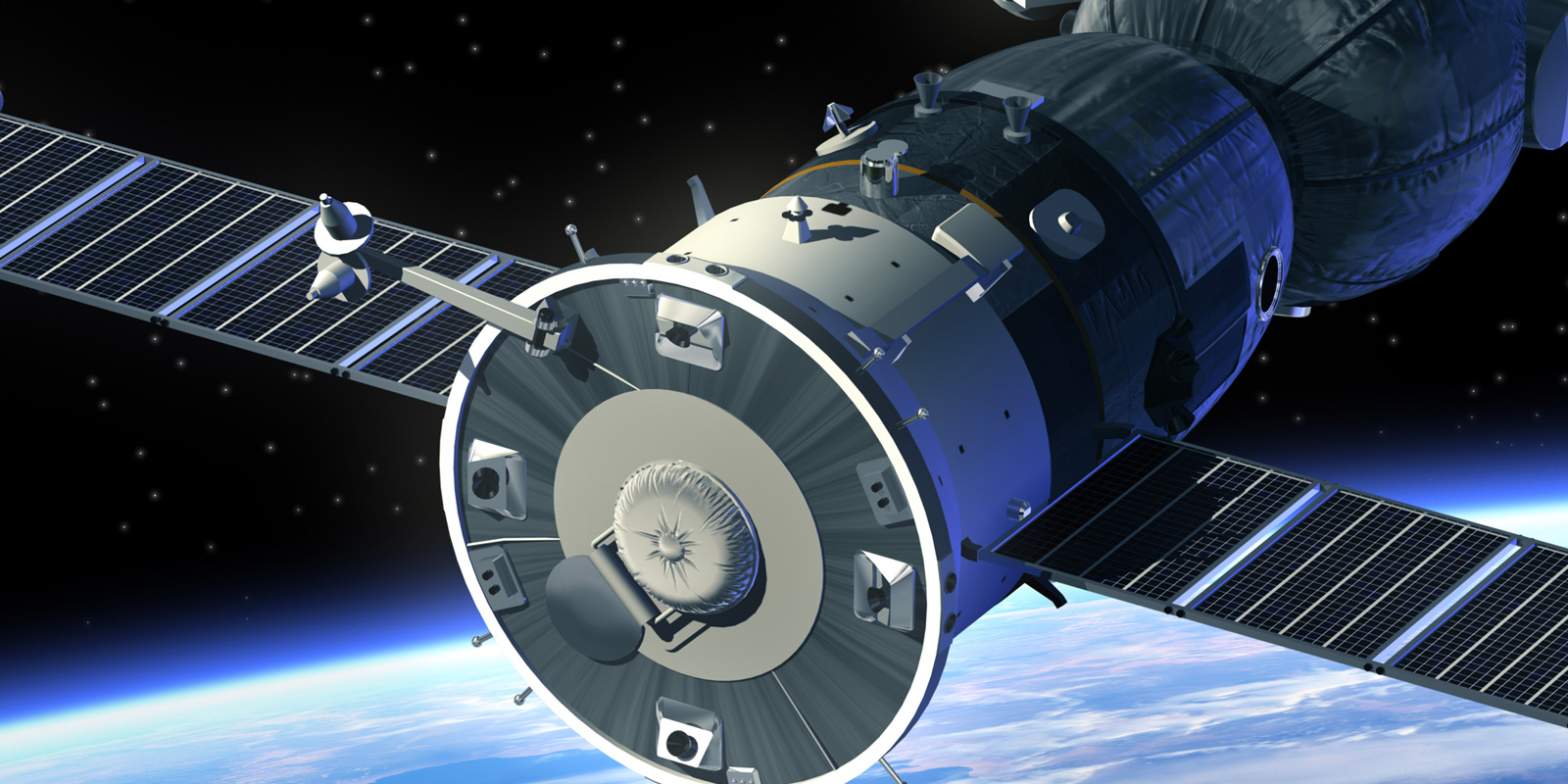

Intelsat is one of the world’s largest satellite services businesses, providing a critical layer in the global communications infrastructure. Intelsat operates the largest, most advanced satellite fleet and connectivity infrastructure in the world, is the leading provider of commercial satellite communication services to the U.S. government and other select military organizations and their contractors, and is the largest direct provider of in-flight connectivity services to commercial airlines.