Greenhouse Gas Emission Reporting for Petroleum and Natural Gas Industry Overhauled

In Short

The Situation: The United States Environmental Protection Agency ("EPA") was required to overhaul the greenhouse gas reporting requirements for the petroleum and natural gas industry by the Inflation Reduction Act ("IRA") in anticipation of the upcoming fee to be imposed on those emissions.

The Result: New regulations applicable for the 2025 reporting year expand the emission sources subject to reporting and update the emission calculation methods for most equipment at regulated facilities.

Looking Ahead: Identifying additional greenhouse gas emissions by requiring reporting from additional sources such as "other large release events" could result in additional revenue pursuant to upcoming methane emission fees.

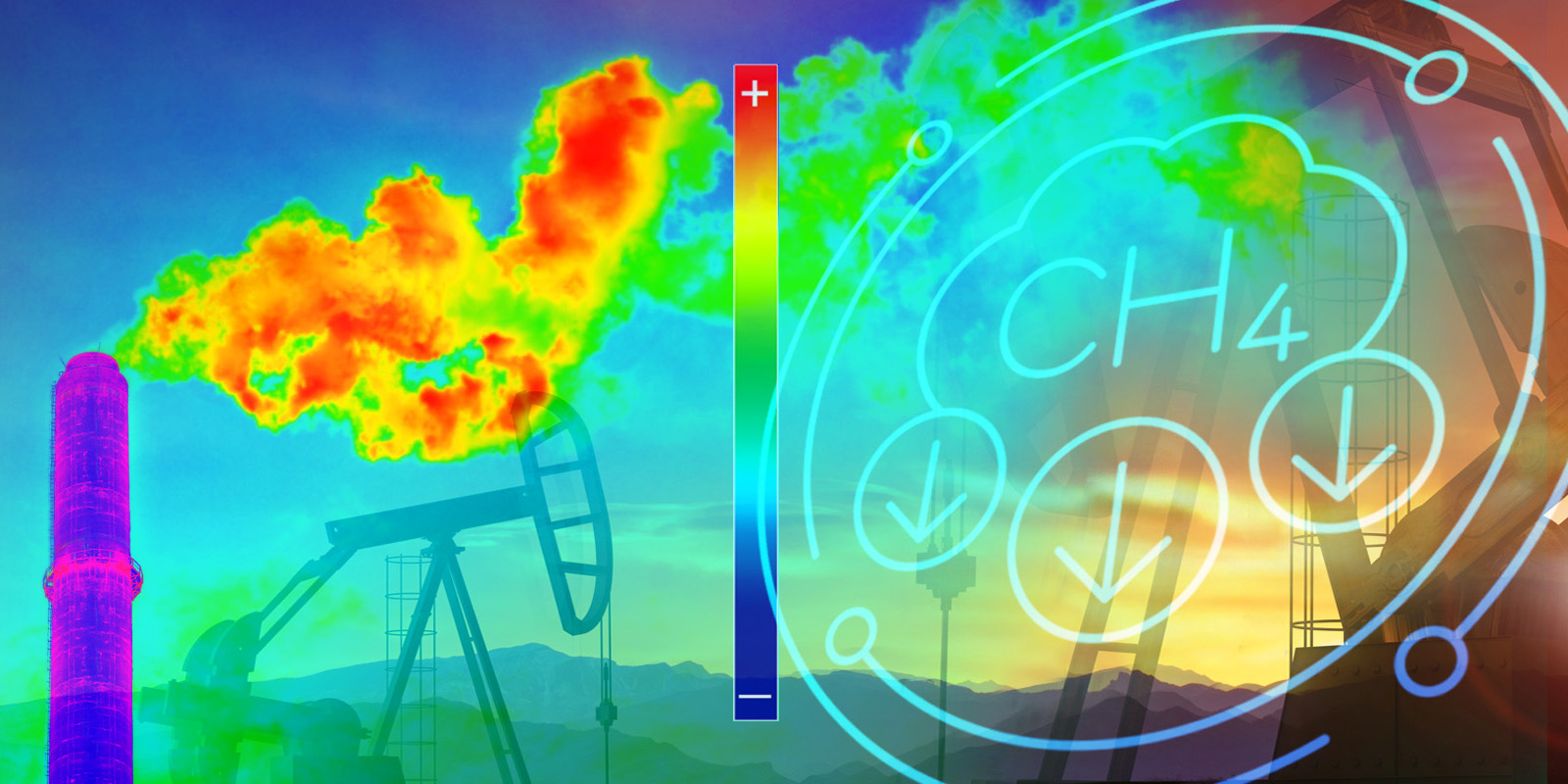

EPA has finalized amendments to the greenhouse gas emission reporting regulations for the petroleum and natural gas industry that expand the specific emission points subject to reporting and update emission calculation methods in anticipation of the upcoming fee for methane emissions.

Section 136(h) of the IRA requires EPA to revise the existing regulations for greenhouse gas emissions from the petroleum and natural gas industry to ensure the regulations report emissions based on "empirical" data and "accurately reflect the total methane emissions and waste emissions from the applicable facilities." The revised regulations apply to about 8,000 reporting sources within the crude petroleum and natural gas extraction industries along with natural gas distribution and pipeline transportation facilities.

These reporting regulations are the second step in a three-pronged regulatory approach of EPA under the Biden administration to address releases of methane by the petroleum and natural gas industry. The first step was final regulations in December 2023 to limit methane emissions from new and existing facilities. The final step will be upcoming regulations implementing a fee on methane emissions in excess of designated standards beginning with emissions in 2024 and payable in March 2025.

A key provision of the final greenhouse gas reporting regulations is the expansion of reporting obligations to additional emission sources. For example, "other large release events," nitrogen removal units, produced water tanks, mud degassing, and crankcase venting emissions will be required to be reported. In addition, industry segments subject to reporting for blowdown vent stacks, natural gas pneumatic device venting, dehydrator vents, and acid gas removal units will be expanded.

"Other large release events" are intended to be a catch-all category for planned and unplanned uncontrolled releases to the atmosphere of gas, liquids, or a mixture thereof that result in emissions for which there are no methods specified in the rules for estimating the emissions, such as well blowouts, accidents, and equipment rupture. The category also includes equipment and component failures to the extent the emissions exceed the calculated emissions using designated calculation methods.

The threshold for reporting these large release events is a methane emission rate of 100 kilogram/hour or more at any time. The final rule deleted the additional threshold in the proposed rule that the event must exceed a 250-metric ton of carbon dioxide equivalent. This means that relatively small, short-term releases that exceed the final threshold would require reporting. In the public comments, some states raised a concern that reporting of these small releases would create an undue administrative burden on regulators. EPA also concluded that the default duration for releases if the actual start date is not known is 91 days, a reduction from 182 days in the proposed rule.

A contentious issue in the comments on the proposed rule was whether annual emissions could be calculated using remote sensing technology, such as satellites. Except for measuring other large release events, EPA generally did not adopt remote sensing methods for determining methane emissions, asserting that the current technology only detected emissions at a discrete moment in time. Instead, the updated regulations generally rely on calculated emissions from individual sources. EPA also did not include a provision requested in public comments allowing EPA to automatically incorporate remote sensing without additional rulemaking. EPA has indicated, however, that it will consider additional information gathering to evaluate technologies and potentially incorporate updated technologies into the regulations in the future.

An additional change from the proposed regulations is related to the obligation to amend past emission reports following sale of a facility. Under the proposed rules, a buyer and seller of reporting facilities would be required to designate a "reporting representative" with responsibility for amending past reports if necessary after a sale. EPA deferred the proposed provisions for resolution in the upcoming methane fee regulations, where EPA also plans to address responsibility for any methane fees resulting from the amended reports. EPA did not alter an existing provision, however, providing that responsibility for reporting rests with the entity owning a facility on December 31 of the reporting year.

With the exception of some calculation methods that can be used at the option of the facility after July 15, 2024, the regulations generally take effect on January 1, 2025, and will apply to reports for the 2025 reporting year due on March 31, 2026. Facing an August 16, 2024, deadline to finalize the regulations under the IRA, it is also expected that the final regulations were issued outside the 60-legislative-day deadline for potential review under the Congressional Review Act if there is a change in administration following the November election.

Three Key Takeaways

- The new reporting regulations attempt to capture greenhouse gas emissions from the petroleum and natural gas industries using updated "empirical" data.

- Additional source reporting and updated calculation methods will require impacted facilities to overhaul monitoring and reporting procedures by January 1, 2025.

- The final step in EPA triad to reduce methane emissions from petroleum and natural gas emissions is upcoming regulations on using reported emissions to calculate methane fees applicable to emissions beginning in 2024.