The Unshell Draft Directive: Only a Few Months Left to Comply?

A draft European Union ("EU") Directive tackling the use of shell entities for tax purposes is currently being negotiated, with potential corrective measures to be considered.

On December 22, 2021, the European Commission adopted a draft Directive laying down rules to prevent the misuse of shell entities for tax purposes (COM/2021/565 final) (the "Unshell Directive" or "ATAD3"). Negotiations around this draft are still pending among Member States.

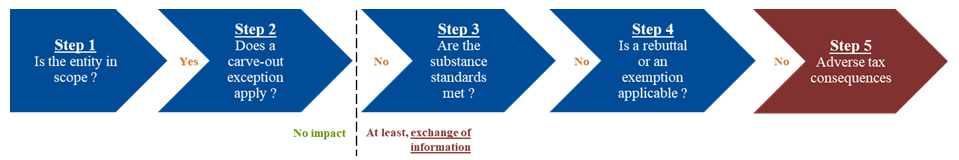

As it stands, the Unshell Directive relies on five successive steps, the result of which will determine whether a given entity is: (i) out of scope; (ii) in-scope and subject only to exchange of information between EU Member States; or (iii) in-scope and lacking substance, thus subject to exchange of information as well as adverse tax consequences.

Here is a summary of the five-step mechanism:

Generally, ATAD3 would target EU-located entities that: (i) accrue mainly passive income from foreign jurisdictions (such as holdings); (ii)are engaged in certain cross-border activities; (iii)outsource the administration of day-to-day operations and decision-making on significant functions; and (iv)do not meet certain physical substance standards including:

- The owning or exclusive use of premises;

- The existence of at least one own and active bank account in the EU; and

- The existence of at least one executive director, or the majority of full-time employees, exclusively working for the entity, with the adequate qualifications and residing for tax purposes at a distance compatible with the proper performance of their duties for the entity.

Exchange of Information: In-scope entities would be subject to detailed reporting of their premises, bank accounts and corporate officers/employees, allowing EU tax authorities to check whether they have sufficient substance.

Adverse Tax Consequences: Entities lacking substance within the meaning of ATAD3 would suffer adverse tax consequences such as the denial of benefits under double tax treaties and/or EU directives and tax residency certificates.

Considerations: In their current form, ATAD3 would indeed apply as from January 1, 2024, based on a two-year look-back period. Accordingly, the way in which companies are organized and governed in 2022 and 2023 may impact whether they will be in scope in 2024. Therefore, preliminary analysis and corrective measures, if required and to the extent possible, should be carried out in the coming months.