The Hammer Falls: U.S. Antitrust Agencies Issue Final Antitrust Merger Guidelines

As expected, the final guidelines expand the types of transactions that may receive heightened scrutiny or result in a merger challenge.

The U.S. Department of Justice Antitrust Division ("DOJ") and Federal Trade Commission ("FTC") recently issued final new merger guidelines. As previewed in the draft guidelines from July 2023, the final guidelines reset the standards by which competitive harm is measured and expand the types of transactions that may receive heightened scrutiny.

Like the July draft, the final guidelines represent a significant departure from earlier guidance and recent case law, instead relying on dated legal precedents (largely from the 1960s). Although the agencies made a number of revisions to the July draft, the fundamental takeaways remain the same. Key provisions include:

- A lower threshold for market shares that result in a "structural" presumption of harm, as compared to the 2010 Guidelines.

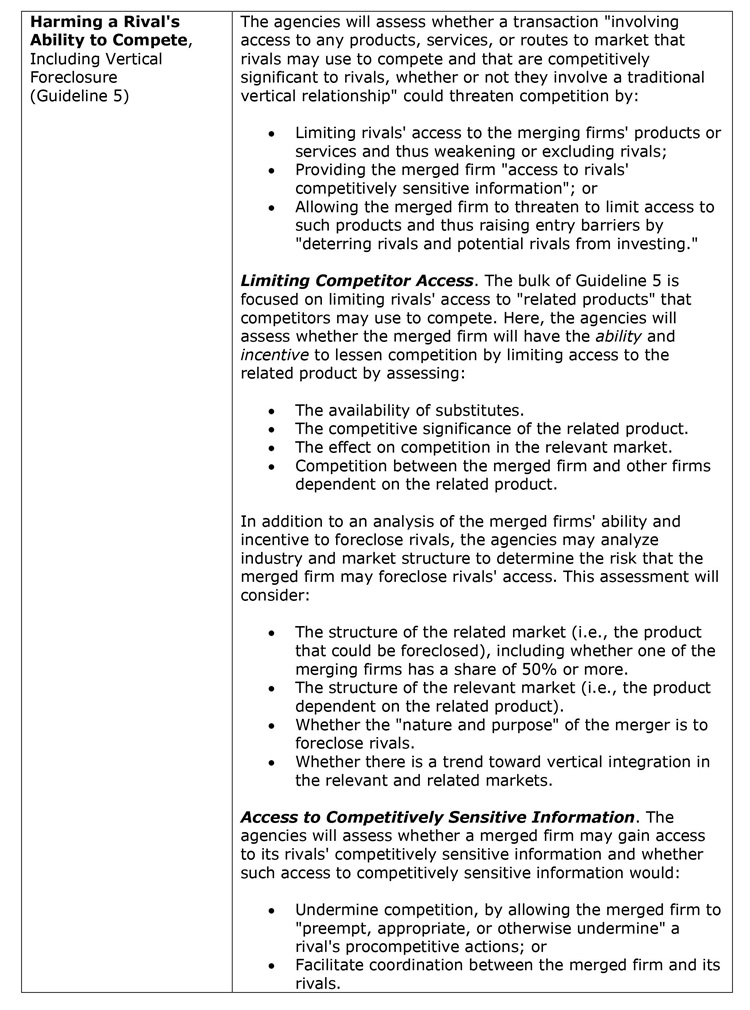

- Increased scrutiny of vertical transactions.

- Heightened focus on input markets, including labor markets.

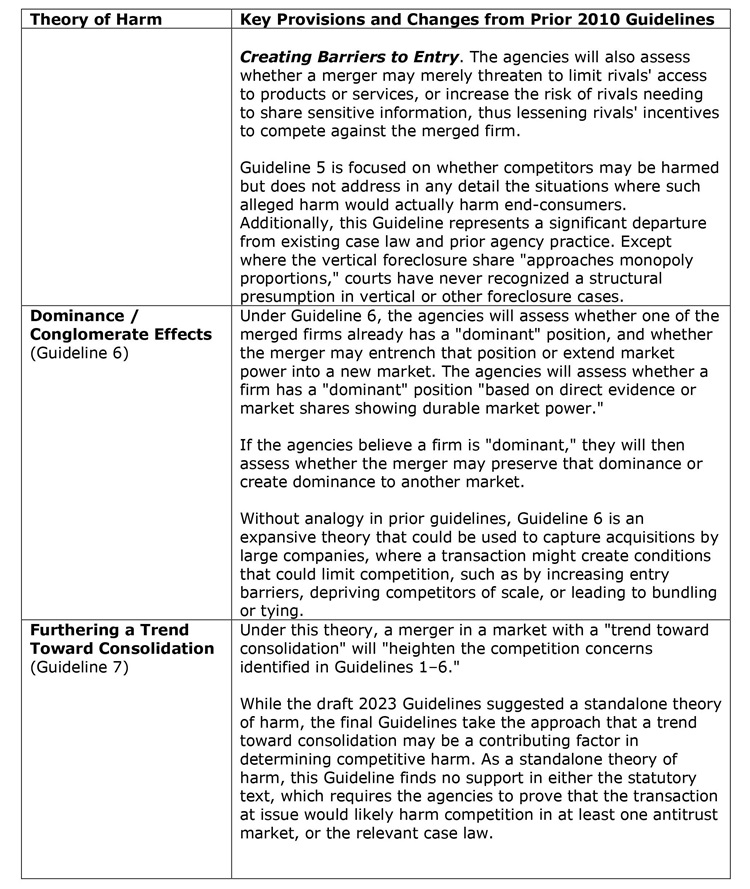

- The introduction of so-called "conglomerate" theories of harm, under which the agencies may challenge a deal even if the parties are not competitors or in a customer–supplier relationship.

- A focus on mergers that might "extend" or "entrench" a dominant firm's position.

- Theories of harm based on industry-wide trends toward consolidation and "roll-up" acquisitions by a single firm.

To their credit, the DOJ and FTC did make modest improvements over the draft. For example, the guidelines:

- Remove the formal "presumption" of harm for certain types of vertical transactions, i.e., those where one party's share of a critical input or output market is 50% or more. (Notably, however, the final guidelines still contain language suggesting such "foreclosure shares" are a "sufficient" basis to infer harm to competition.)

- Improved the analysis of merger benefits in two ways: (i) by removing a provision that would have discredited efficiencies just because they might "accelerate a trend" toward concentration or vertical integration; and (ii) by acknowledging one type of benefit (the elimination of double marginalization) present in vertical transactions.

- The agencies also incorporated new language acknowledging that inferences of competitive harm are subject to rebuttal evidence. M&A is not per se illegal. Even if the government seeks to establish a presumption of harm, merging parties can rebut or disprove that presumption.

The final guidelines are consistent with the Biden administration's mission to re-energize antitrust enforcement. Indeed, although the guidelines are new, the policies animating them are not—M&A has been subject to heightened antitrust scrutiny over the past three years. Yet despite this more aggressive posture, the vast majority of transactions that are subject to U.S. merger review still are cleared within 30–60 days and without challenge. And agency guidelines are not binding in court. The DOJ and FTC must ultimately convince a federal judge that a transaction violates the law.

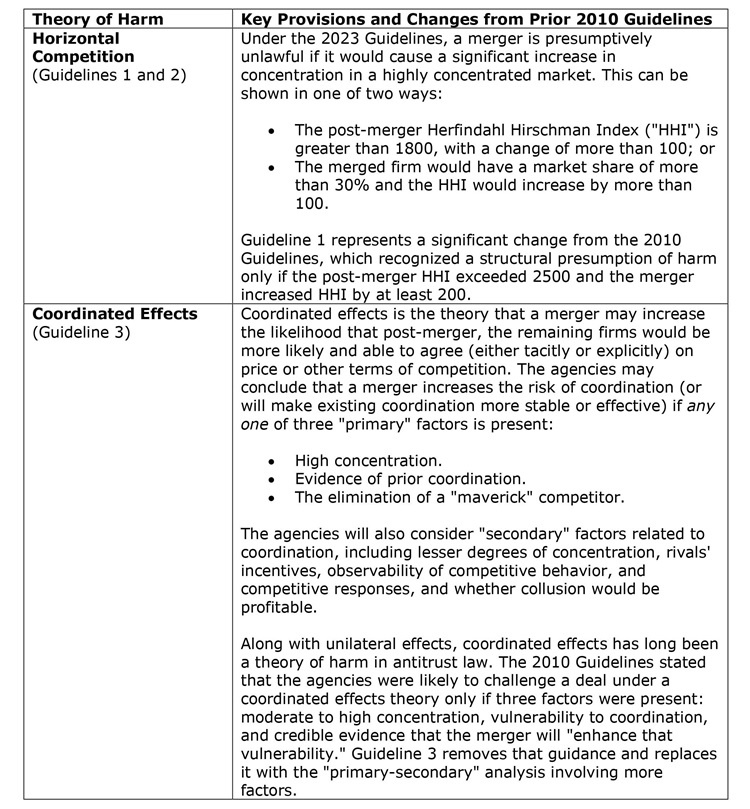

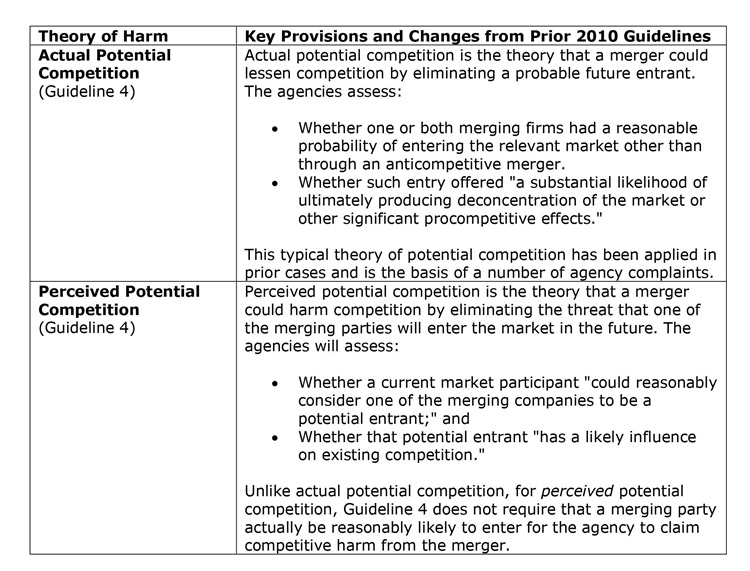

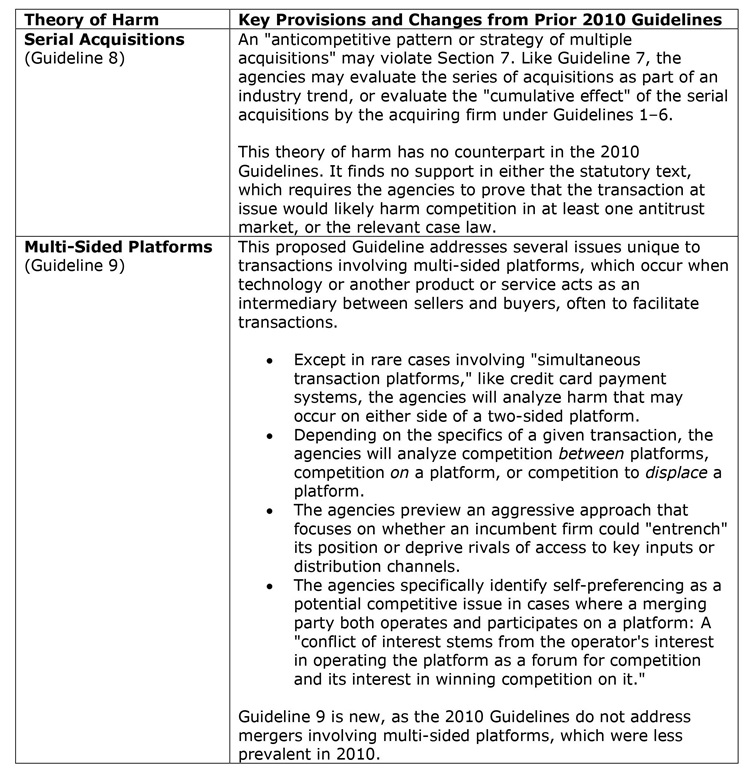

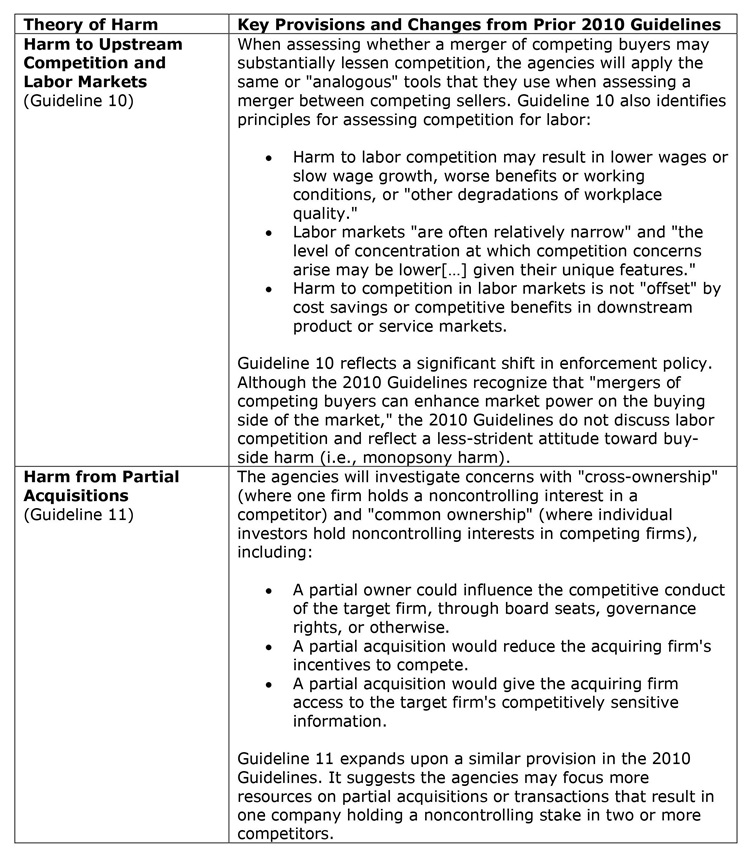

The table below summarizes the theories of harm presented in the final guidelines and the implications of each.