Members of Intelsat Jackson Crossover Group to own 96% of reorganized Intelsat equity following complex chapter 11 plan confirmation process

Client(s) Ad Hoc Intelsat Jackson Unsecured Noteholders Group

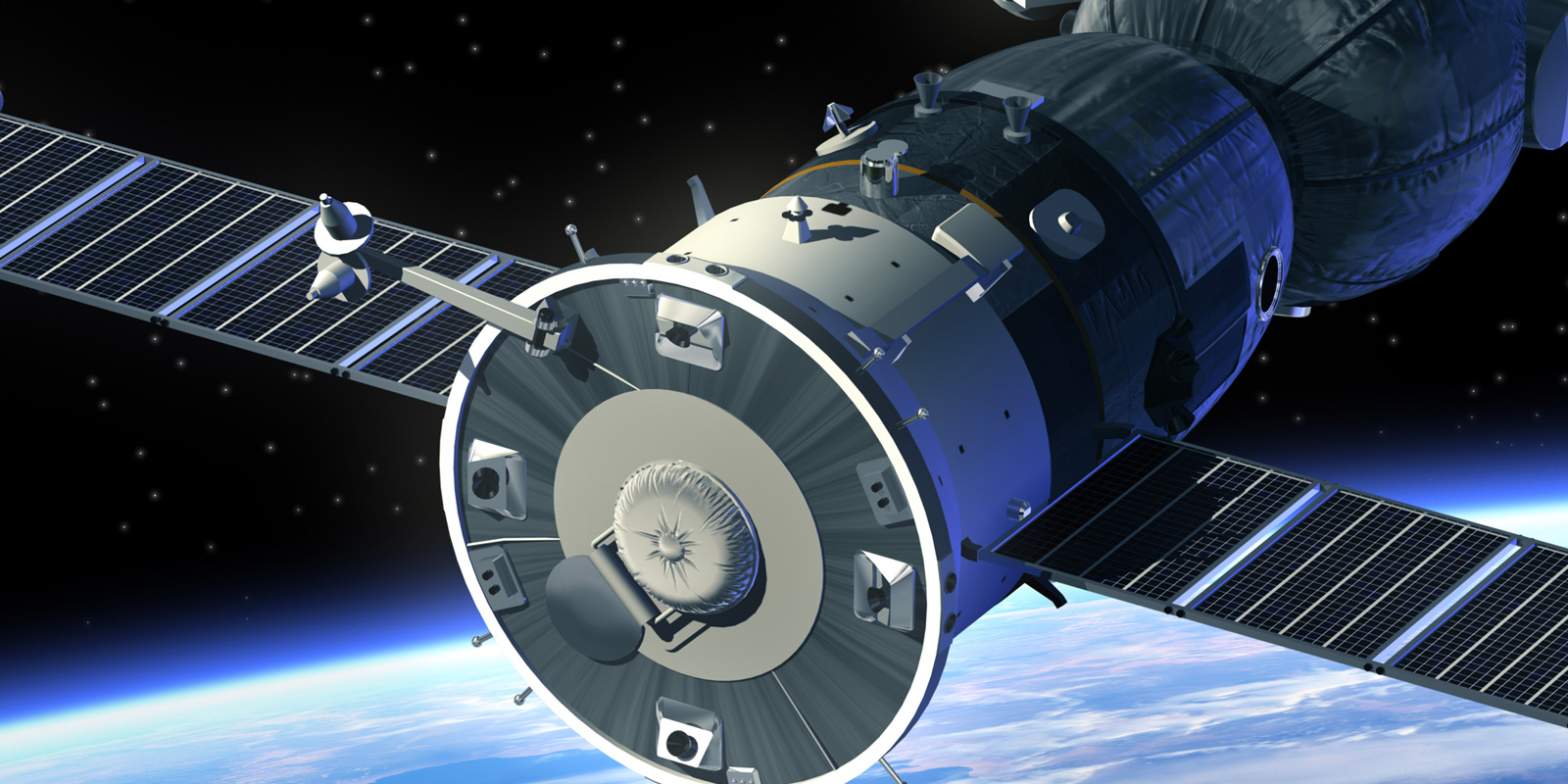

Jones Day represents the largest creditor constituency (the "Jackson Crossover Group") holding more than 47% ($7 billion) of the debtors' entire funded debt in the highly complex chapter 11 cases of In re Intelsat S.A., et al. (Case No. 20-32299-KLP), pending in the Eastern District of Virginia bankruptcy court (the "Bankruptcy Court"). Intelsat is one of the world's largest commercial satellite providers and has a $14.7 billion prepetition capital structure. The Jackson Crossover Group holds approximately 78% of the unsecured debt, as well as a portion of the secured debt, issued by Intelsat Jackson Holdings S.A., the debtor entity that directly and/or indirectly owns all of Intelsat's operating entities and assets and houses nearly all of Intelsat's employees. On December 17, 2021, the Bankruptcy Court entered an order confirming the debtors’ chapter 11 plan of reorganization whereby members of the Jackson Crossover Group will hold 96% of the reorganized debtors’ equity.

Jones Day represents the Jackson Crossover Group in every facet of the Intelsat bankruptcy cases, including in complex issues related to restructuring (pre- and post-plan confirmation), tax, corporate, finance (including DIP and exit financing), securities, regulatory, and executive and employee benefits law. Jones Day also works closely with AKD Luxembourg (local Luxembourg counsel for the Jackson Crossover Group) to advise the group with respect to complex Luxembourg law issues.