Australia Proposes Major Reforms to Merger Review Regime

In Short

The Background: The Australian Federal Treasurer recently announced sweeping reforms to Australia's merger review regime. These reforms will overhaul the current merger review regime in Australia to introduce mandatory filing requirements for notifiable transactions, "bringing Australia into line with most other developed economies" (per the Australian Competition and Consumer Commission ("ACCC")).

The Result: The new regime will greatly increase the ACCC's regulatory powers. Importantly, once the reforms take effect, merging parties may not close notifiable transactions until regulatory approval is obtained. Previously, there was no mandatory antitrust notification requirement in Australia, and the decision to notify a transaction was effectively made by transaction counterparties and their advisors.

Looking Ahead: These reforms are set to take effect on January 1, 2026. Much of the detail of Treasury's proposals are yet to be finalized and will be subject to further consultation, with exposure draft legislation widely anticipated to be introduced toward the end of 2024.

On April 10, 2024, the Australian Federal Treasurer announced sweeping reforms to Australia's merger review regime, stating, "[t]hese changes I announce today are the biggest reforms to merger settings in almost 50 years." The proposed reforms are published in a report by the Australian Treasury.

Similar to premerger notification regimes in other jurisdictions, the proposed reforms in Australia would require merging parties for transactions exceeding certain thresholds to notify the competition authority and observe a waiting period before closing.

These reforms will impact transactions by leading to new conditionality, increased time frames, and additional costs—including as a result of filing fees, filing preparation, and government engagement. The new process may also delay the closing of many transactions.

The chair of the ACCC has advised that the ACCC will receive additional funding to assist with its transition to the new merger regime. The chair has also indicated that the ACCC will be preparing and consulting on draft guidelines and preparing a standardized form for filings.

Notifiable Transactions

The thresholds for notification have not yet been finalized, but Treasury will likely set them by reference to business metrics such as total deal value, turnover of the parties or profitability, and/or market shares.

The ACCC has previously recommended that transactions exceeding a global transaction value of AU$35 million (approximately US$23 million) or that involve an acquirer or target with global turnover of at least AU$400 million (approximately US$265 million) should be notifiable. While not explicitly stated, there presumably also will be a requirement that the relevant transaction has some connection to a market in Australia.

Additionally, the reforms will expressly apply to serial transactions (creeping acquisitions). Specifically, all transactions within the previous three years by an acquirer or a target will be aggregated for the purposes of assessing whether a transaction meets the notification thresholds. This could impact transactions that would otherwise fall below the notification thresholds.

If merging parties close a notifiable transaction before obtaining approval, the transaction will be deemed void, and the parties may face substantial penalties. Penalties also will apply for providing false or misleading information to the ACCC in the notification process. The precise nature of the penalties is yet unknown, but they are expected to apply to both companies and individuals.

The proposals also contemplate that all notified transactions and ACCC merger review decisions will be published on a public register.

Time Frame for ACCC Review

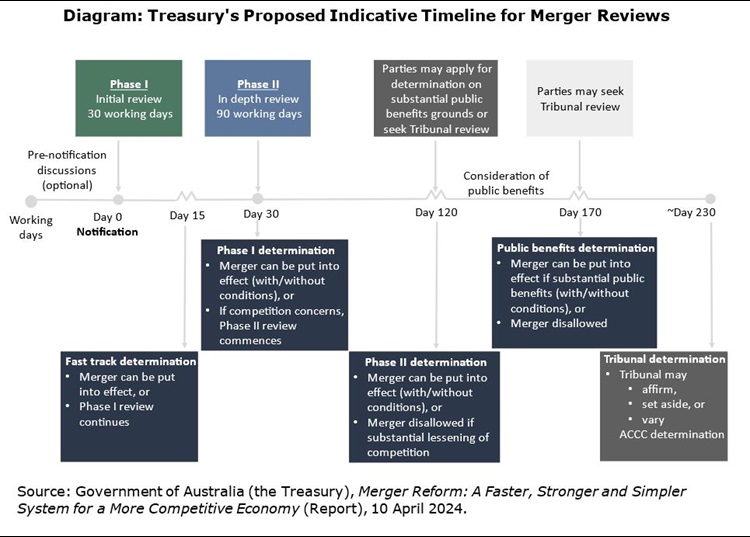

Treasury's proposal contemplates a decision by the ACCC within 30 working days (i.e., six weeks) after the parties file for a "Phase 1 review," with potential approval in 15 working days under a "fast-track determination" process if the ACCC raises no competition concerns. A further review period of 90 working days for a "Phase 2 review" will apply if the ACCC has a reasonable basis to consider that the transaction raises competition concerns.

If the ACCC makes an adverse Phase 2 determination to disallow the transaction, the merger parties may either:

- Seek a review of the ACCC's determination from the Australian Competition Tribunal (the "Tribunal"); or

- Apply for a determination from the ACCC that considers the public benefits of the transaction, with a further review period of approximately 50 working days. If an adverse determination is still made by the ACCC, the merger parties may seek a review of this determination from the Tribunal.

It is presently unclear when the ACCC will be able to extend the time frame or impose clock stops in relation to any of the phases of review.

A diagram of Treasury's proposed timeline appears below.

Review of ACCC Decision

Treasury's proposal contemplates that ACCC decisions will be subject to a limited merits review by the Tribunal. The Tribunal will be able to affirm, set aside, or vary the decision of the ACCC—including to impose conditions. With limited exceptions, the Tribunal's review will be restricted to the materials that were available to the ACCC at the time it made its decision.

The Tribunal's decision will then be subject to judicial review in federal court.

Filing Fees

Treasury's proposal states that the filing fees for most transactions will be between AU$50,000 and AU$100,000, with fees scaled to reflect the transaction's complexity and risk. Combined with the recent increases to Foreign Investment Review Board filing fees, these fees will have an impact on transaction costs for many cross-border transactions (this is in line with trends in other major jurisdictions).

Three Key Takeaways

- Many details are still unknown, but it is clear that future notifiable transactions in Australia will be subject to mandatory merger review and cannot close until regulatory approval is obtained. The timeline for merger review must also be factored into notifiable transactions.

- Treasury's proposal also targets serial transactions, such that an individual transaction that does not itself exceed the notification thresholds may become notifiable when considered in conjunction with other recent transactions (each of which itself may not exceed the notification thresholds). The ACCC may also become aware of merger parties' past, previously unnotified, transactions (that may even have occurred prior to the commencement of the reforms) in the course of its review of notifiable transactions.

- The proposed reforms will bring Australia into line with peer jurisdictions that already require notification of transactions that meet certain thresholds.