Hong Kong Exchange Publishes Consultation Paper on Listing Regime for Specialist Technology Companies

In Short

The Situation: Hong Kong currently falls behind the United States and Mainland China in terms of the number and market capitalization of companies belonging to the "Specialist Technology Industries."

The Development: The Stock Exchange of Hong Kong Limited (the "Exchange") proposes to amend the Listing Rules to provide for listing of "Specialist Technology Companies" on the Main Board of the Exchange.

Looking Ahead: It is believed that "Specialist Technology Industries" generally carry positive investment characteristics that attract strong investment demand. The new proposals are expected to encourage more innovative and new economy companies to pursue a listing in Hong Kong and increase the accessibility of the Hong Kong market.

On October 19, 2022, the Exchange published the Consultation Paper on Listing Regime for specialist technology companies proposing to introduce a new chapter ("Chapter 18C") to the Main Board Listing Rules ("Listing Rules") to implement a new regime for the listing of specialist technology companies on the Main Board of the Exchange. The Exchange invited market feedback on the proposed Listing Rules updates by December 18, 2022.

Specialist Technology Industries and Acceptable Sectors

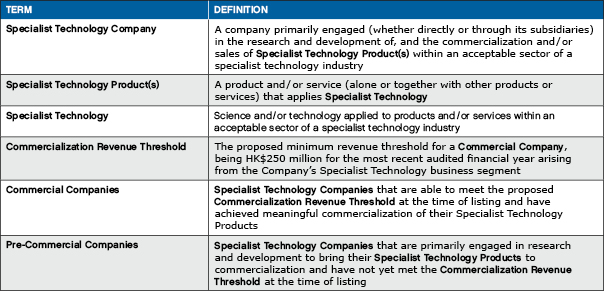

The Consultation Paper sets out the definition of the key terms as follows:

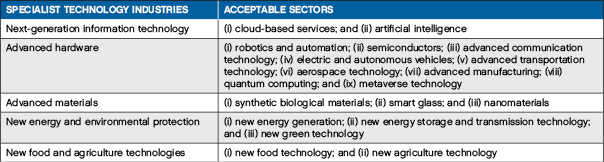

The proposed new regime initially will include companies in the following industries and sectors:

The Exchange may add new industries or sectors from time to time, taking into account the following principles:

- Participants in the relevant sector must have high growth potential;

- The success of participants in the sector can be demonstrated to be attributable to the application, to their core business, of new technologies and/or the application of the relevant science and/or technology within that sector to a new business model, which also serves to differentiate them from traditional market participants serving similar consumers or end users; and

- Research and development significantly contributes to the expected value and constitutes a major activity and expense of participants in the sector.

It is worth noting that the Exchange is of the view that the listing applicants need not possess "leading-edge" technologies. This is in line with the view that the success of a Specialist Technology Company would often be attributed to the successful commercialization of the core technology rather than the innovativeness of the technology itself. Listing applicants with multiple business segments may also take advantage of the proposed new regime if the company is "primarily engaged" in the relevant business of a Specialist Technology Company.

Key Listing Qualifications of the New Regime

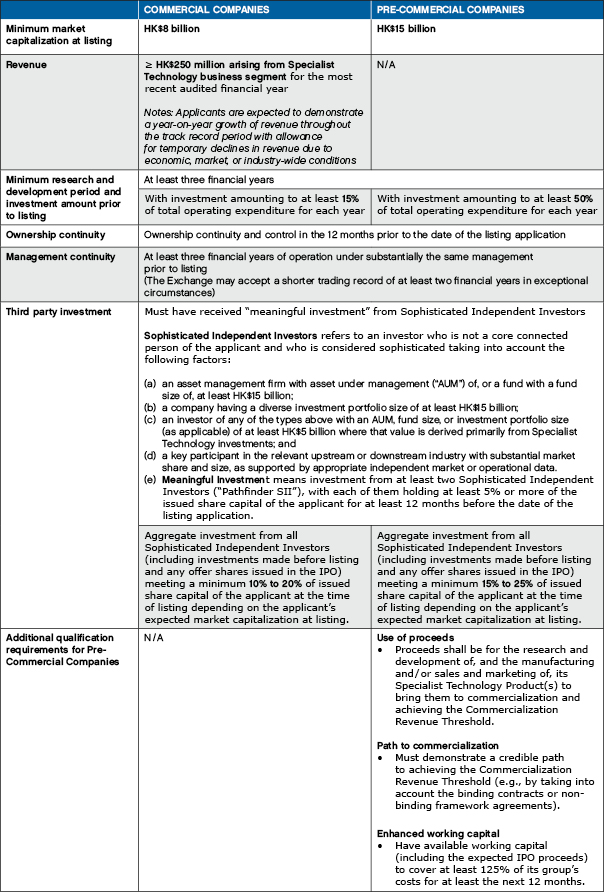

The proposed Chapter 18C categorized Specialist Technology Companies into: (i) "Commercial Companies"; and (ii) "Pre-commercial Companies." Additional listing requirements will apply to Pre-Commercial Companies due to the higher risks associated with these companies.

Below is a summary of the key features and listing qualifications of the new regime:

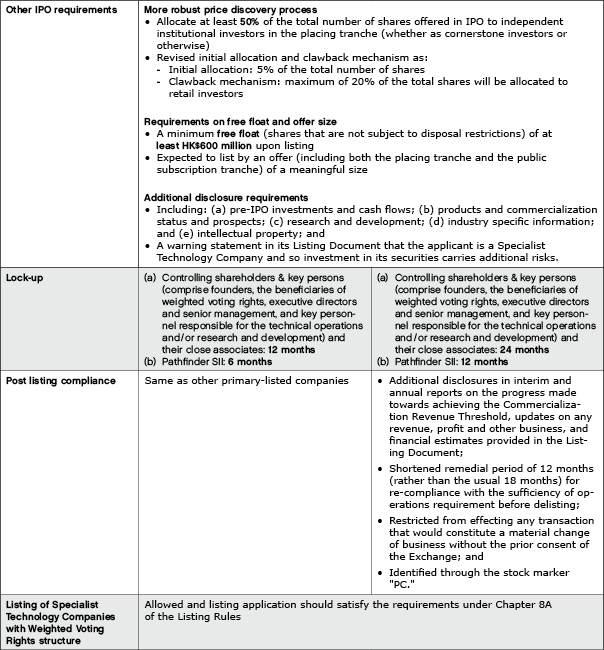

Proposed Requirements for Offering and Post-Listing Compliance

Three Key Takeaways

- The decision to establish a special listing regime for Specialist Technology Companies and implementation of the new proposals is expected to encourage more innovative and new economy companies to pursue a listing in Hong Kong and increase the accessibility of the Hong Kong market.

- The scope of Special Technology Companies is comprehensive with flexibility from the Exchange to add new industries or sectors from time to time.

- Application for listing of Special Technology Companies under the new regime is subject to certain conditions regarding market capitalization and offer size, research and development engagement, investment from Sophisticated Independent Investors, and price discovery process.