NYSE Reproposes to Permit Capital Raising in Direct Listings

Following two prior proposals during 2019, the New York Stock Exchange ("NYSE") has submitted to the U.S. Securities and Exchange Commission ("SEC") an amended proposal to permit capital raising in direct listings.

Key Takeaways

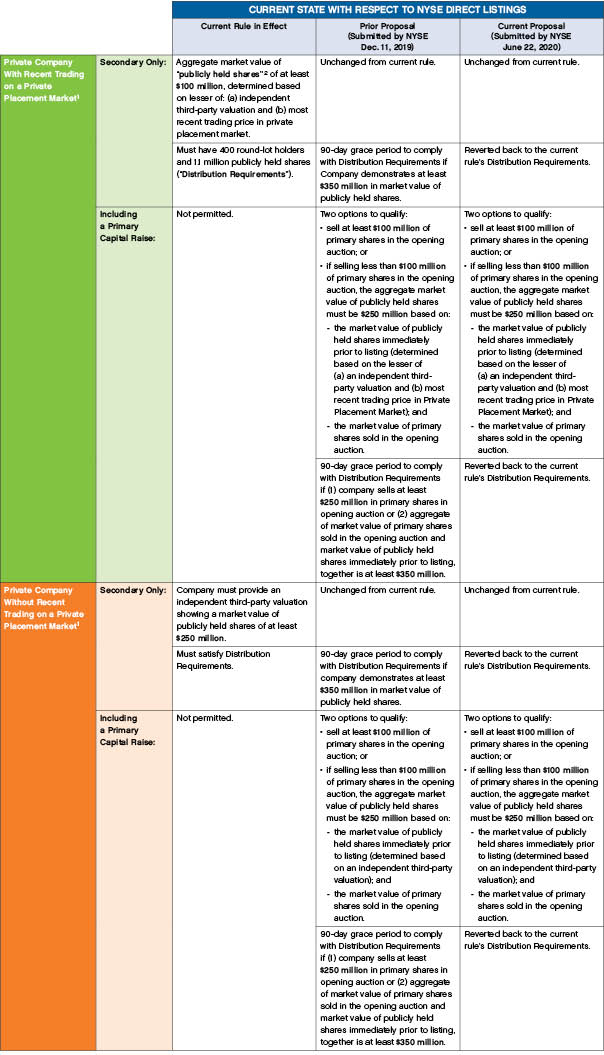

The current proposal, which was submitted by the NYSE on June 22, 2020, would, like the prior proposal, allow a private company seeking to raise capital through a direct listing to satisfy the NYSE's market value requirement by selling at least $100 million of stock. Where less than $100 million of primary shares are offered (regardless of whether the company's shares trade in a private placement market or not), the aggregate market value of publicly held shares for a company pursuing a direct listing must be $250 million.

Currently, NYSE's general listing requirements include another significant obstacle facing companies considering direct listings—the need to have at least 400 round lot holders upon listing. While the NYSE's prior proposal would have provided under certain circumstances a 90-day grace period to satisfy the round lot holder requirement, the NYSE's current proposal mandates that the generally applicable requirement be satisfied upon completion of the direct listing. Because meeting the round lot holder requirement can be a challenging threshold for all but the largest private companies, the retention of this requirement may limit the number of companies that can avail themselves of a direct listing should the proposed rule change be approved.

In addition, the NYSE's current proposal provides details regarding the procedures that would be applicable for primary offering direct listing auctions. While some of the proposed procedures are fairly technical, a few specific elements of the procedures are noteworthy insofar as they could potentially impact pricing and execution flexibility in a direct listing. For example, for any primary direct listing:

- The issuer would be required to identify the primary shares it seeks to sell by placing an irrevocable, unmodifiable issuer direct offering order ("IDO Order") with a "limit" price equal to the low end of a price range specified on the issuer's effective registration statement.

- The auction price, which would be determined by a designated market maker, must fall within this price range, and both the IDO Order and all better-priced sell orders must be satisfied at such price—i.e., an auction would not be conducted if the auction price would be outside of the range (higher or lower), or if there was insufficient buy-side interest to satisfy the IDO Order and all better-priced sell orders in full.

- In a direct listing where the auction price is equal to the lowest end of the range, the issuer's IDO Order has execution priority; in a direct listing where the auction price is within the range, the issuer's IDO Order (as a limit order with the low end of the range as its "limit") will be a better priced offer and will receive execution priority.

Like its earlier proposals, the NYSE's current proposal would address the inability to raise capital in a direct listing, which is one of the most significant limitations facing companies considering direct listings, and would provide greater clarity regarding the pricing mechanisms for primary direct listings. However, the NYSE has reduced the scope of its earlier proposals by retaining the round lot holder requirement and the proposed pricing mechanisms limit an issuer's pricing flexibility based on the price range specified in its registration statement. Therefore, companies considering a direct listing or a traditional initial public offering process should carefully consider the advantages and disadvantages of each approach with legal counsel and investment banking advisors.

For additional information, see our prior publications describing the NYSE original proposal, the SEC's rejection of the original proposal, and the NYSE's prior amended proposal.

The following table presents the current NYSE landscape with respect to listing requirements for direct listings.