Congress Enacts Substantial Increase in U.S. Merger Notification Filing Fees for Large Deals

The Consolidated Appropriations Act, 2023 increases Hart-Scott-Rodino Act filing fees for large transactions, decreases filing fees for small transactions, and requires changes to the HSR Form.

The Consolidated Appropriations Act, 2023 ("CAA"), the omnibus spending bill that Congress passed to fund the government in 2023, introduces additional Hart-Scott-Rodino ("HSR") merger notification filing fee thresholds, increases filing fees for large transactions, and decreases fees for small transactions. Filing fees will increase for more than half of notifiable transactions. The government last updated the filings fees in 2001 when it introduced the existing three-tier fee structure.

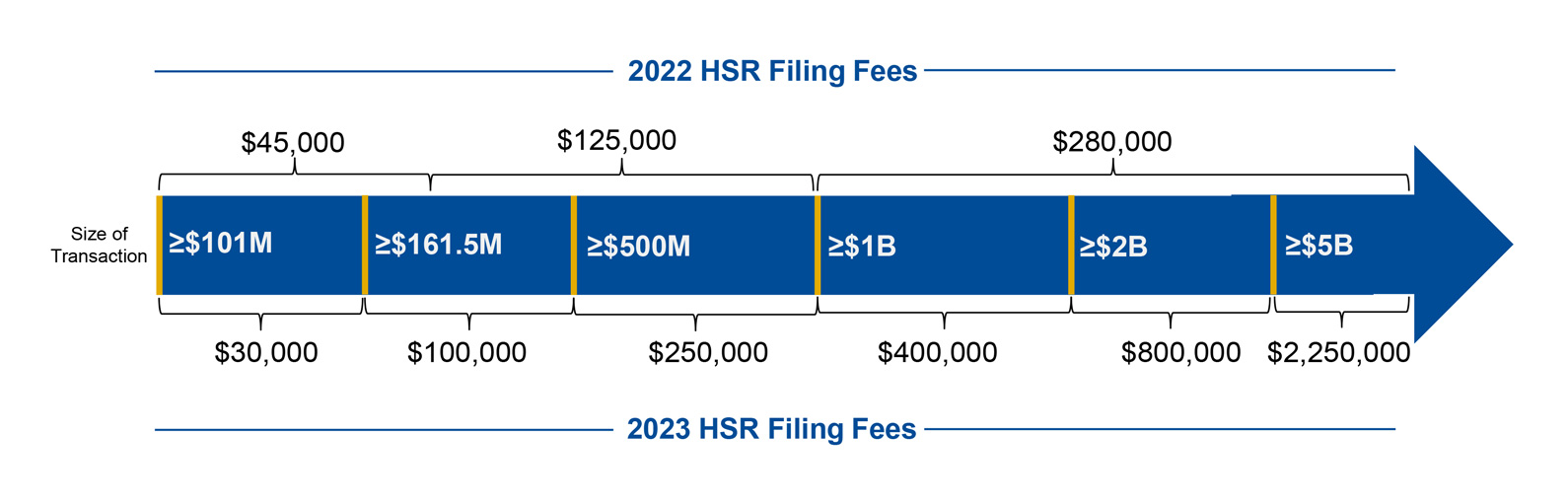

Figure 1 illustrates changes from the existing filing fees to the new six-tier structure. Filing fees will be lower for transactions valued:

- Between $101 million and $161.5 million, decreasing from $45,000 to $30,000 for those deals; and

- Between $202 million and $500 million, decreasing from $125,000 to $100,000 for those deals.

For all other reportable deals, the filing fees will increase. For transactions valued at $1 billion or more (about 15% of notifiable M&A transactions), filing fee increases will be particularly steep:

- $400,000 for deals valued between $1 billion and $2 billion (a 43% increase);

- $800,000 for deals valued between $2 billion and $5 billion (a 186% increase); and

- $2.25 million for deals valued at $5 billion or more (a 704% increase).

Under HSR Act rules, the "size of transaction" may differ from headline deal value. The introduction of three additional filing fee tiers will require closer attention to valuation issues for more transactions to determine which filing fee applies for deals close to a threshold.

Figure 1

The new rules also adjust the filing fees annually based on the change in the Consumer Price Index. The new filing fees will take effect in 2023 after the Federal Trade Commission notice of the change in the fee schedule.

Disclosure of Subsidies from a "Foreign Entity of Concern"

The CAA also requires the Antitrust Division of the Department of Justice, FTC, Committee on Foreign Investment in the United States, and other federal agencies to develop new document or information requests for the HSR Form. Those requests must help DOJ and FTC determine whether an acquisition involving a company that received a subsidy from a "foreign entity of concern," defined in 42 U.S.C. § 18741(a), including the governments of China, Iran, North Korea, and Russia, would violate the antitrust laws.

As highlighted in our December 2022 Alert, the European Union will require prenotification of certain large M&A transactions and public bids involving companies that receive subsidies from governments outside the EU starting in October 2023.