U.S. Merger Notification Threshold Increases to $94 Million

Annual increases in U.S. merger notification thresholds take effect on February 27, 2020.

Please see our 2021 update: U.S. Merger Notification Threshold Falls to $92 Million

This week, the Federal Trade Commission announced its 2020 adjustments to the Hart-Scott-Rodino ("HSR") Act thresholds. These thresholds determine which mergers and acquisitions must be reported to the federal government before consummation. The new thresholds take effect on February 27, and will remain in effect through early 2021.

Earlier this month, the FTC increased the maximum civil penalty amounts for HSR Act violations to $43,280 per day. The agency also announced revisions to the jurisdictional thresholds for the prohibition on interlocking directorates under Section 8 of the Clayton Act.

The revised HSR Act and Section 8 thresholds are described further below.

Adjusted HSR Jurisdictional Thresholds

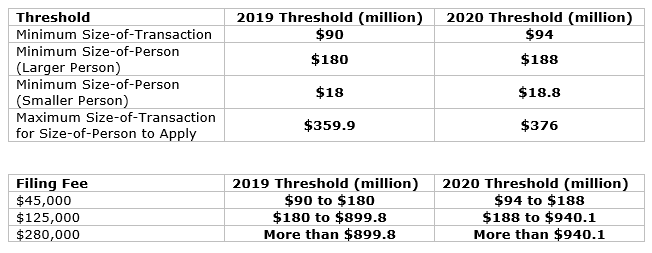

Size-of-Transaction Threshold. An HSR Act filing may be required if the acquirer will hold, as a result of the transaction, voting securities, noncorporate interests, and/or assets of the acquired person valued in excess of $94.0 million (the 2019 threshold was $90.0 million). If the Size-of-Transaction is between $94.0 million and $376.0 million, the transaction also must satisfy the Size-of-Person threshold, described below. Transactions valued in excess of $376.0 million need not satisfy the Size-of-Person threshold.

Size-of-Person Threshold. A transaction meets the Size-of-Person threshold if either the acquired or acquiring person has annual net sales or total assets of at least $188.0 million and the other party to the transaction has at least $18.8 million in annual net sales or total assets. (The 2019 thresholds were $180 million and $18 million, respectively.) Note: If the acquired person is not "engaged in manufacturing," the threshold is crossed only if it has at least $18.8 million in total assets or $188 million in annual net sales.

The tables summarize these threshold changes.

New Interlocking Directorates Thresholds

Clayton Act Section 8 prohibits a single person from serving as an officer or director of competing corporations if certain thresholds are met. The revised Section 8 threshold prohibits an individual from serving as an officer or director of competing corporations if each company has a net worth of more than $38,204,000(Section 8(a)(1)). However, there is no violation if the competitive sales of either are less than $3,820,400(Section 8(a)(2)(A)).