Mandatory Clearing of OTC Derivatives in the EU—A Buy-Side Perspective

Jones Day published a White Paper titled "The European Market Infrastructure Regulation and Transparency in the OTC Derivatives Market" in November 2013, which describes the provisions of the European Market Infrastructure Regulation ("EMIR") including, inter alia, the scope of EMIR’s clearing requirements and the "over-the-counter" ("OTC") derivatives counterparties which will be affected by this Regulation. Since the publication of our White Paper, various regulatory technical standards ("RTS") proposed by the European Securities and Markets Authority ("ESMA") in connection with the implementation of EMIR have been adopted. This White Paper focuses on the RTS for the first mandatory clearing obligation relating to interest rate swaps ("IRS")[1] ("Delegated Regulation") which came into force on 21 December 2015 and sets the time frame running for phasing in mandatory clearing of OTC derivatives in the EU commencing on 21 June 2016.

The purpose of this White Paper is to provide a brief outline of the commercial and documentation issues related to clearing which may affect corporates, alternative investment funds ("AIFs") and institutional counterparties on the "buy-side" of OTC derivatives transactions. For the reasons set out herein, buy-side counterparties are advised to prepare for mandatory clearing well in advance of the clearing obligations becoming applicable to them.

Following the Referendum, until the UK formally ceases to be a member of the EU, EMIR continues to apply to the UK as adopted, and any changes will depend on the outcome of Brexit negotiations with the EU.

What is Mandatory Clearing?

Clearing is the process by which bilateral OTC derivatives contracts ("OTC Contract") are "novated" to an authorised[2] Central Counterparty ("CCP") which interposes itself between the two original contracting parties. The CCP effectively becomes the sole contractual counterparty of party A, on the one hand, and the sole contractual counterparty of party B, on the other hand. One effect of such novation is, for both original contracting parties, to shift their mutual bilateral credit risk under the transaction to a CCP. Mandatory clearing of certain OTC derivatives is thought to ensure greater stability of the markets in major crisis scenarios.

As a practical matter, unless the original contracting parties are Clearing Members of the CCP ("CM"), transactions can be cleared only by a CCP through a CM offering to its client the services of a "clearing broker". Most CCPs have prescribed criteria for admission as CMs, including obligations to make capital contributions and to maintain minimum capital requirements. Also, clearing brokers generally seek to offer such services to their clients across many asset classes, time zones and CCPs. As such, CMs offering such brokerage services are usually major financial institutions which meet multiple CCPs’ criteria. A counterparty which is not a CM itself must therefore have a contractual agreement in place with a CM in order to be able to submit its "leg" of an OTC derivative transaction to a CCP for clearing. This Counterparty-CM arrangement is the focus of this White Paper.

It is worth noting that CCPs operate under different "clearing models". Essentially, two main models co-exist in the derivatives markets. The most common model in use in Europe is known as the "principal-to-principal model". In this model, the CM is the sole counterparty to the CCP, and the financial rights and obligations arising under the cleared transaction are "passed" to the CM’s client via a back-to-back transaction. U.S. CCPs, however, generally operate under an "agency model", whereby the CM merely acts as an agent for its client who is the sole legal counterparty to the CCP under the cleared transaction. This White Paper focuses on clearing arrangements entered into under the principal-to-principal model.

Before discussing the issues arising from the contractual clearing arrangements to be entered into between a counterparty and a CM, we set out below the basic framework for clearing obligations under EMIR.

WHICH TYPES OF OTC CONTRACTS ARE SUBJECT TO CLEARING?

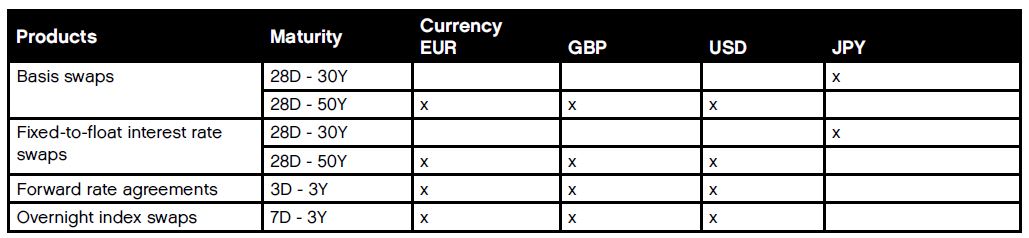

Under the Delegated Regulation, certain types of standard and liquid IRS will be the first group of OTC Contracts subject to clearing based on maturity and classification categories. In particular, the following classes of derivatives would be affected:

In its current application, only transactions with constant or variable notional amounts would be cleared and not transactions subject to optionality as to value, such as an interest rate forward option. Each authorised CCP will also have its own internal set of criteria as to the types of transactions which would be accepted for clearing.

Under the Delegated Regulation, two key exemptions are provided for OTC Contracts which would otherwise be subject to mandatory clearing:

- certain contracts entered into with covered bond issuers or with cover pools for covered bonds for the purpose of hedging interest rate or currency mismatches on the cover pool relating to the covered bonds; and

- intragroup transactions meeting certain conditions prescribed by EMIR, notably the requirement to notify the relevant competent authority (in the case of the UK, the FCA, and in the case of France, the AMF or the ACPR depending of the legal status of the relevant notifying party) of a counterparty’s intent to be exempted from clearing. Such notification must be made in writing to the relevant competent authority no less than 30 calendar days prior to the exemption being used.

WHICH COUNTERPARTIES ARE AFFECTED?

EMIR clearing obligations will affect the above-referenced in-scope OTC Contracts entered into by one of the following groups of counterparties:

- where one or both counterparties is either a financial counterparty[3] ("FC") or an NFC+ (a counterparty which is not an FC but with OTC derivatives transactions with notional amounts exceeding the clearing threshold[4]);

- where one party is either an FC or an NFC+ and a non EU counterparty which would be subject to mandatory clearing if it were established in the EU ("Qualifying Third-Country Entities");

- two Qualifying Third-Country Entities where the OTC Contract has a direct, substantial and foreseeable effect[5] within the EU, or where such a clearing obligation is necessary or appropriate to prevent the evasion of any provision in EMIR.

WHEN WILL THE CLEARING OBLIGATIONS COME INTO FORCE?

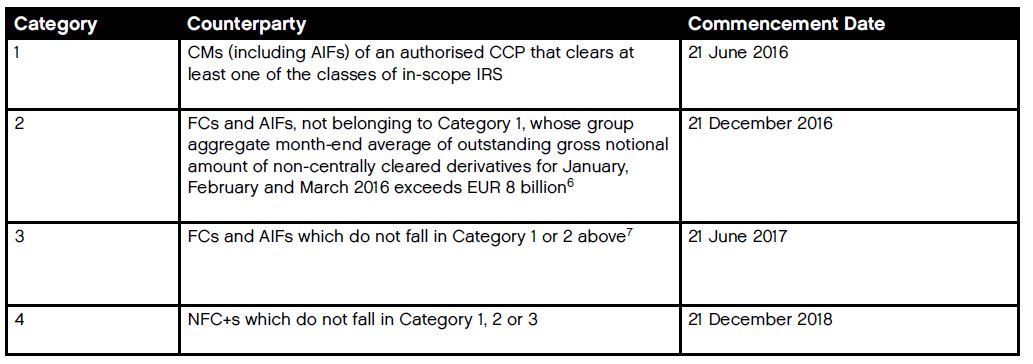

The Delegated Regulation prescribes the following timing for phasing in of in-scope OTC Contracts:

If an OTC Contract is entered into between counterparties in two different categories, then the later commencement date will apply.

FRONTLOADING

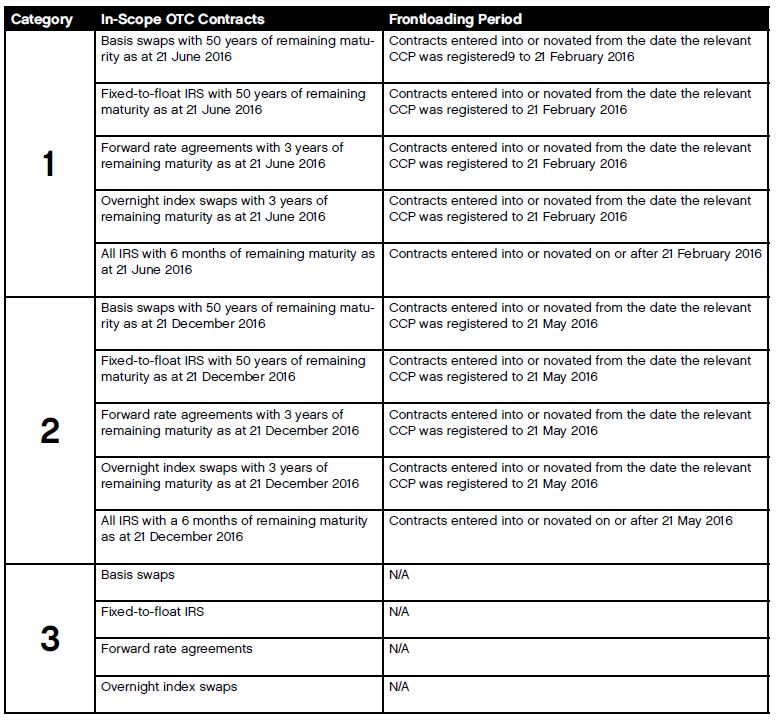

Notwithstanding the specified commencement dates above, EMIR also requires that OTC Contracts which: (i) are of a type that would be subject to mandatory clearing by an FC, and (ii) were entered into or novated prior to the commencement date of the clearing obligation, also be subject to clearing, depending on the maturity date of the transaction as set out in the table below. This is referred to as "frontloading".

Under the Delegated Regulation, OTC Contracts entered into by counterparties falling within Categories 1 and 2 above are subject to frontloading. The frontloading periods applicable for Category 1 and Category 2 counterparties do not apply to counterparties falling in Category 3. However, in-scope OTC Contracts entered into or novated to counterparties in Category 3 would be subject to mandatory clearing if those OTC Contracts have a remaining maturity period as specified in the Delegated Regulation[8]on the date mandatory clearing becomes applicable.

The following table summarises the commencement dates of frontloading in connection with each class of in-scope contracts and with the relevant maturity dates:

Under EMIR, OTC Contracts which are subject to frontloading must be submitted to a CCP for clearing unless terminated.

EXTRATERRITORIAL APPLICATION OF THE DELEGATED REGULATION

As outlined above, an OTC Contract entered into between two Qualified Third-Country Entities could be subject to mandatory clearing within the EU. The issue is further complicated if one of the Third-Country Entities is also already subject to mandatory clearing obligations imposed by the laws of the jurisdiction in which it is incorporated. In response, EMIR prescribed that to comply with mandatory clearing, all in-scope OTC Contracts must be cleared through either a CCP which is authorised or established in the EU or a CCP established outside the EU in a jurisdiction for which ESMA has issued an equivalence decision.

As at the date of this White Paper, ESMA has issued equivalence decisions in respect of CCPs located in Australia, Canada, Hong Kong, Japan, Mexico, Singapore, South Africa, South Korea, Switzerland and the United States.

THE COUNTERPARTY–CM ARRANGEMENT—KEY ISSUES TO CONSIDER IN PREPARATION FOR CLEARING

For buy-side counterparties, the following practical considerations should be considered in preparation for clearing and contractual arrangements with CMs.

Choosing a CM Relationship

As a CM is a counterparty’s gateway to clearing, it is important that an appropriate CM is selected. Most non-CM counterparties will logically enter into clearing arrangements with CMs with whom they already have a trading relationship. However, it should be noted that although a counterparty and a client’s relationship in a derivatives transaction is a bilateral, two-way relationship, this is not the case where the counterparty is also acting as a CM. The CM sees itself as merely providing a service to the client (as opposed to being a contractual counterparty in an OTC contract) and would typically act as "riskless principal" in respect of the transactions which are submitted to clearing by the CCP. The following additional issues should be considered.

Multiple CM Relationships. One of the key features of clearing is to mitigate against the credit and operational risks of CMs. In the event of a CM default, a client should be able to preserve its position by "porting" its cleared OTC transactions and the associated collateral to another CM. Under certain circumstances, transactions can also be ported in the absence of a default. It is easier to port a transaction to a CM with whom there is already an existing contractual relationship. Accordingly, it is recommended that non-CM counterparties should enter into clearing arrangements with at least two CMs so that the non-defaulting CM can serve as the porting CM.

CM’s Arrangement with CCPs. An important consideration in choosing a CM is whether the CM has the operational capacity to clear a wide range of derivatives transactions with multiple CCPs. Each CCP will have its own "Rules Set" with which a CM, as a member of that CCP, must comply. As the non-CM counterparty in a principal-to-principal clearing model does not have a direct contractual relationship with the CCP, the counterparty relies upon the CM to facilitate clearing and posting of margin. It is important for a counterparty to know the CCPs in which a CM is a member and the CCPs’ Rules Set in respect of the types of trades that can be cleared and the applicable margin requirements.

CM’s Commercial Terms with its Counterparties. Some of the key commercial terms to consider include:

- the CM’s fees;

- trading limits which may be imposed by the CM;

- the CM’s margin requirements: For each trade to be cleared, the client is required to post initial margin ("IM") and variation margin ("VM") to the CCP. IM and VM are posted to the CCP by the CM, as principal. However, CMs will require IM and VM to be simultaneously posted with them by their clients to enable the CM to fulfil margin obligations of a specific trade to the CCP. To limit operational risks, CMs may require a client to post excess margin with it, as a buffer collateral. It is important for a client to understand a CM’s margin requirements from the outset as this has cost implications. The types of margin required by the CCP and CM should also be addressed as some CMs will accept only cash to satisfy its excess margin requirements. Another important consideration is the CM’s position on the timing in which unused collateral would either be returned to the client or be managed by the CM to optimise the economic benefits of collateral posted; and

- termination: A non-CM counterparty should ensure that if the CM is in default or the client otherwise wishes to port the transactions and the associated collateral to a new CM, it can do so swiftly and without excessive additional costs. As discussed further below, the ability to port a transaction is the counterparty’s only remedy against a CM if there is a default or if a counterparty is not satisfied with the services provided by that CM.

Margin Segregation at CCP Level.

Under EMIR, CMs must operate separate accounts for their own assets and those of their clients. In respect of client accounts, CCPs and CMs must offer their client or counterparty a choice between an individual segregated account or an omnibus account.

- Individual Segregated Account. An individual segregated account is a specific account opened in the name of the CM for the account of the counterparty and into which only the positions and margins posted by the counterparties are held, distinct and separate from positions and assets held by such CM for the account of any of its other clients.

- Omnibus Account. An omnibus account is one where all positions and assets held by one CM for the account of all its clients are recorded. There are mainly two variations of omnibus accounts:

- Net Omnibus: Under this structure, the positions of all client counterparties electing this account will be aggregated to determine the amount of margin which would be required to be posted. The benefit of this account is that due to the aggregation of the positions, the overall margin requirement could be reduced. However, if there is a CM default, a shortfall may occur in the collateral returned to each counterparty because margin would be returned on the net position. This is the quid pro quo for a reduced margin for a particular trade.

- Gross Omnibus: Margin for accounts under this structure would be determined on a gross basis, i.e., margin for each position would be determined on a client-by-client basis. However, the CCP does not record the exact type of margin posted by a counterparty or whether it is attributable to a particular trade. Hence, on a CM default, the CCP may return only the value of the margin to the client and not the exact type or collateral which was posted.

Different account fees typically apply to each of the accounts set out above. Selection of the most appropriate account will also be determined by the type of transactions a client enters into and the ease with which the collateral can be transferred from one CM to another if a transaction is required to be ported.

Clearing Documentation.

For most non-CM counterparties, the following documentation will be required in order to facilitate and comply with EMIR’s clearing requirements:

- an execution agreement between a client and the executing broker;

- an industry master agreement between the client and the CM, e.g., the ISDA or FBF Master Agreement;

- a clearing agreement between the client and the CM, e.g., the ISDA/FOA Clearing Addendum;

- a financial collateral agreement in respect of margin requirements, e.g., the ISDA Credit Support Annex;[10] and

- ancillary documentation commonly used in the market to facilitate the operations and compliance with regulations in the jurisdictions of incorporation of the parties, e.g., the ISDA EMIR Protocols.

As the FOA/ISDA Clearing Addendum ("Clearing Addendum") is anticipated to be the most widely used agreement to document clearing arrangements between a counterparty and a CM, we have summarised below a number of key issues which buy-side counterparties may confront in navigating and negotiating the Clearing Addendum. In France, the FBF has published an addendum to the Clearing Addendum allowing its use with the FBF Master Agreement governed by French law.

Basic Architecture. The Clearing Addendum is entered into between the CM and the counterparty, under which the CM agrees, subject to certain conditions, to accept OTC Contracts entered into by its client for clearing, by "submitting" the OTC Contracts to a CCP. Once a transaction is submitted for clearing, each CM on both sides of the original trade enters into a transaction with the CCP in relation to the cleared trade ("CM-CCP Trade"). Each CM is then simultaneously deemed to enter into an OTC derivative transaction with its client ("CM-Client Trade"), the terms of which are the same but economically opposite to the terms of the CM-CCP Trade, with the effect that the economics of the CM-CCP Trade are passed to the client. As the CM is a direct counterparty to the CCP under a principal-to-principal model, the CM is exposed to the credit risks of the client in respect of the CM-Client Trade, which again is merely an OTC derivative transaction. The CM seeks to mitigate its exposure by requiring appropriate collateral to be posted and including relevant contractual protections in the clearing documentation.

Restriction of a Client’s Termination Rights Against the CM. Due to the back-to-back structure of the principal-to-principal clearing model, the client’s ability to terminate any transactions (which could be mutually agreed in a non-cleared transaction) has been amended so that the counterparty can terminate a cleared transaction only if the CM defaults and such default also causes the CCP to declare a default under the CM-CCP Trade. This means that the counterparty may need to continue to perform its obligations even if the CM has defaulted. As such, it is important that the Clearing Addendum allows the client to port all transactions to another CM with reasonable ease.

Conditions to Porting, Pre- and Post-CM Default. Section 5 of the Clearing Addendum prescribes the conditions and procedure for porting a transaction from one CM to another. Pre-default transfers involve a strict set of conditions which must be met before a transfer can be effected. Buy-side counterparties should carefully consider the conditions that a CM would impose on a pre-default transfer to ensure that they are workable from a portfolio management perspective. Another important consideration is to ensure that upon a transfer, all margin posted can be returned in order to be re-posted to the new CM. A potential weakness in this framework is that in order to exercise a right to port, the counterparty must have a back-up CM in place and will have to meet the terms on which that back-up CM will agree to accept the trade for clearing, noting that CMs generally do not have the contractual obligation to accept any trade for clearing. If the market is under stress, the counterparty may find itself unable to port a transaction.

In the event of a CM default, buy-side counterparties may also be faced with a limited amount of time under the CCP’s Rules Set to request the CCP to port the transaction to another CM. Additionally, as a practical matter, the CCP will be able to port transactions only to a CM which is also a member of that CCP, and any porting would be subject to the terms imposed by the new CM. An added complication in porting under a CM default is that the margin which is posted with the defaulted CM may not be released immediately depending on the applicable insolvency regimes or where its assets, including client accounts, are controlled by an insolvency administrator. In this situation, the counterparty may well be required to post additional new collateral to the new CM in order to maintain the transaction.

The above emphasises the importance of our recommendation that non-CM counterparties should enter into clearing arrangements with at least two CMs so that the non-defaulting CM can serve as the porting CM. They should also arrange for such CMs, once appointed, to organize regular portability exercises on significant portions of the portfolios, to make sure, well before any stress or crisis scenarios, that porting could operationally be implemented in a swift and efficient manner.

CCP’s Rules Set; Modification Events. Under a principal-to-principal model structure, the client does not have a direct contractual relationship with the CCP. Nevertheless, the Clearing Addendum expects a counterparty to be familiar with the CCP’s Rules Set as it expressly provides that the CM’s compliance with such Rules Set is not jeopardised by the counterparty’s actions. Moreover, the CCP can amend its Rules Set from time to time without the consent of the CM or the client. If as a result of a change in a CCP’s Rules Set, the terms of the CM-CCP Trade has changed, the Clearing Addendum provides that the CM-Client Trade will also be changed to eliminate any mismatch. If the change results in a loss to the CM or vice versa, a payment to be calculated by the CM would be required to be made. Furthermore, if a CM finds that as a result of a change in the CCP’s Rules Set, it becomes "impossible or impracticable" for it to maintain the CM-Client Trade, then the CM would be entitled to terminate that transaction with notice to the client.

No Obligation for a CM to Accept a Transaction for Clearing. Under the standard form Clearing Addendum, a CM has no obligation to accept any transaction for clearing. If a transaction cannot be cleared by a CM, the client will need to find another CM to clear it. If no CM is willing and able to clear a transaction, the transaction will have to be terminated at the then-prevailing market conditions. It is therefore of utmost importance to ensure that a CM can reject a transaction only under limited circumstances which are precisely defined.

Limited Recourse; Indemnity. The Clearing Addendum contains extensive indemnification and limited recourse provisions whose purpose is to protect and preserve the CM’s riskless principal position. Under the limited recourse provision, the CM’s performance under the CM-Client Trade is entirely dependent upon the performance by the CCP under the CM-CCP Trade. If a CM-CCP Trade and hence the CM-Client Trade is terminated due to a CM default and the impossibility of porting the transaction to another CM, any payment which a client is entitled to receive in respect of such termination is dependent on the CCP making the corresponding payment under the CM-CCP Trade. Under a principal-to-principal model, due to the back-to-back nature of the CM-CCP Trade and the CM-Client Trade, the termination payment amounts with respect to these two transactions should, in theory, be equal. If the CCP’s calculation of the termination amount payable under the CM-CCP Trade is different from the termination amount payable under the CM-Client Trade, the client will have no recourse against the CM.

A related risk area from this approach for buy-side counterparties relates to the margin posted in respect of the terminated transaction. Depending on the type of client account selected and the CCP’s calculation of the collateral to be returned on a terminated transaction, it is possible that there can be a mismatch in the amount of collateral that the client will receive from the CCP. If there is a shortfall, the client will have no recourse against the CM.

In addition, the Clearing Addendum contains an extensive indemnification provision whereby the client is liable to indemnify the CM for any loss which it may suffer in connection with the Clearing Addendum. On the other hand, the CM’s liability to the client is limited pursuant to Section 12 of the Clearing Addendum. Depending on its volume of activity, buy-side counterparties may consider negotiating these provisions.

* * *

Clients are well-advised to review its OTC Contracts with a view to putting in place the necessary clearing arrangements with the CM as soon as possible, particularly given the complexity of the documentation invoked.

[1] As set out in the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015.

[2] Under EMIR, only CCPs authorised and recognised by ESMA can give effect to the clearing obligations required by EMIR.

[3] A counterparty which is a Financial Counterparty under EMIR usually included EU established banks, insurance/assurance/reinsurance undertakings, AIFs managed by alternative investment managers, investment firms, UCITS and its management company (where relevant) and pension funds.

[4] The clearing thresholds are as follows:

- EUR 1 billion in gross notional value for OTC credit derivative contracts and OTC equity derivative contracts; and

- EUR 3 billion in gross notional value for OTC interest rate derivative contracts, OTC foreign exchange derivative contracts and OTC commodity derivative contracts.

[5] Contracts between two Third-Country Entities will be deemed to have direct, substantial and foreseeable effect if:

- They are between EU branches of the Third-Country Entities and those Third-Country Entities would qualify as FCs if they were established in the EU; or

- At least one counterparty benefits from a guarantee given by an EU FC which: (i) covers all or part of that Third-Country Entity’s liability where the aggregate notional amounts of the contracts exceed EUR 8 billion; and (ii) is equal to at least 5 percent of the guarantor’s aggregate OTC derivatives exposure.

[6] Subject to the conditions set out in Article 3(2) of the Delegated Regulation, with regard to in-scope contracts between counterparties (other than counterparties in category 4) which are part of the same group and where one counterparty is established in a third country and the other in the EU, the clearing obligation shall take effect from (i) 21 December 2018 in case no equivalence decision has been adopted pursuant to Article 13(2) of EMIR, or (ii) if an equivalence decision was adopted, the later of (a) 60 days after the date of entry into force of the equivalence decision adopted pursuant to Article 13(2) of EMIR and (b) dates where the clearing obligation enters into force, depending of the category of the counterparty as described in the chart.

[7] See endnote 6.

[8] The minimum remaining maturity of OTC Contracts subject to clearing, as at 21 June 2017 is:

- 50 years for basis swaps and fixed-to-float IRS; and

- Three years for forward rate agreements and overnight index swaps.

[9] For example, LCH Clearnet Ltd was registered for the products covered by this RTS on 12 June 2014. Other CCPs have registered for clearing the same products subsequently.

[10] In this respect, commencing from 1 September 2016, new IM and VM requirements will apply to OTC Contracts that are subject to clearing. As such, the existing credit support agreements will have to be amended or revised in respect of OTC Contracts subject to clearing.